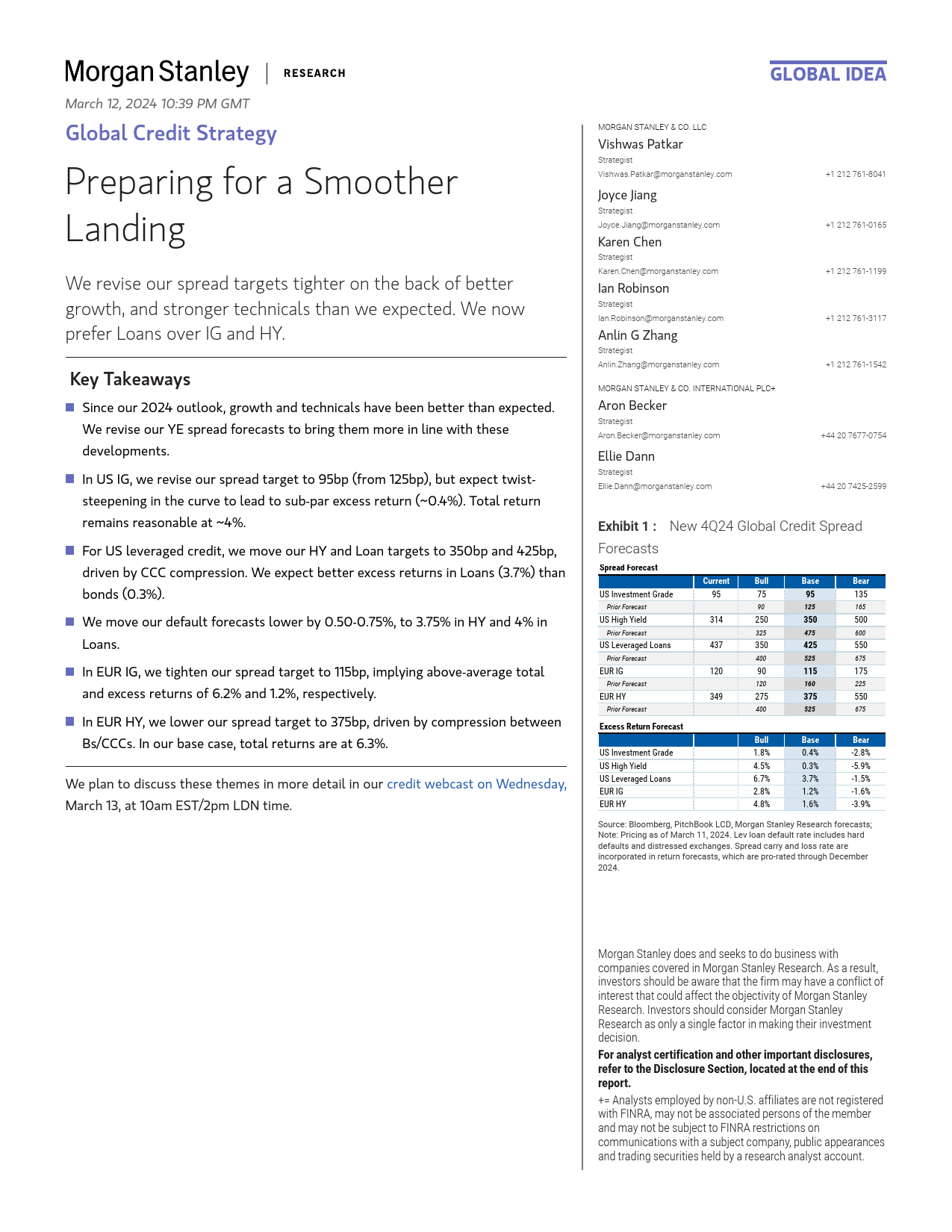

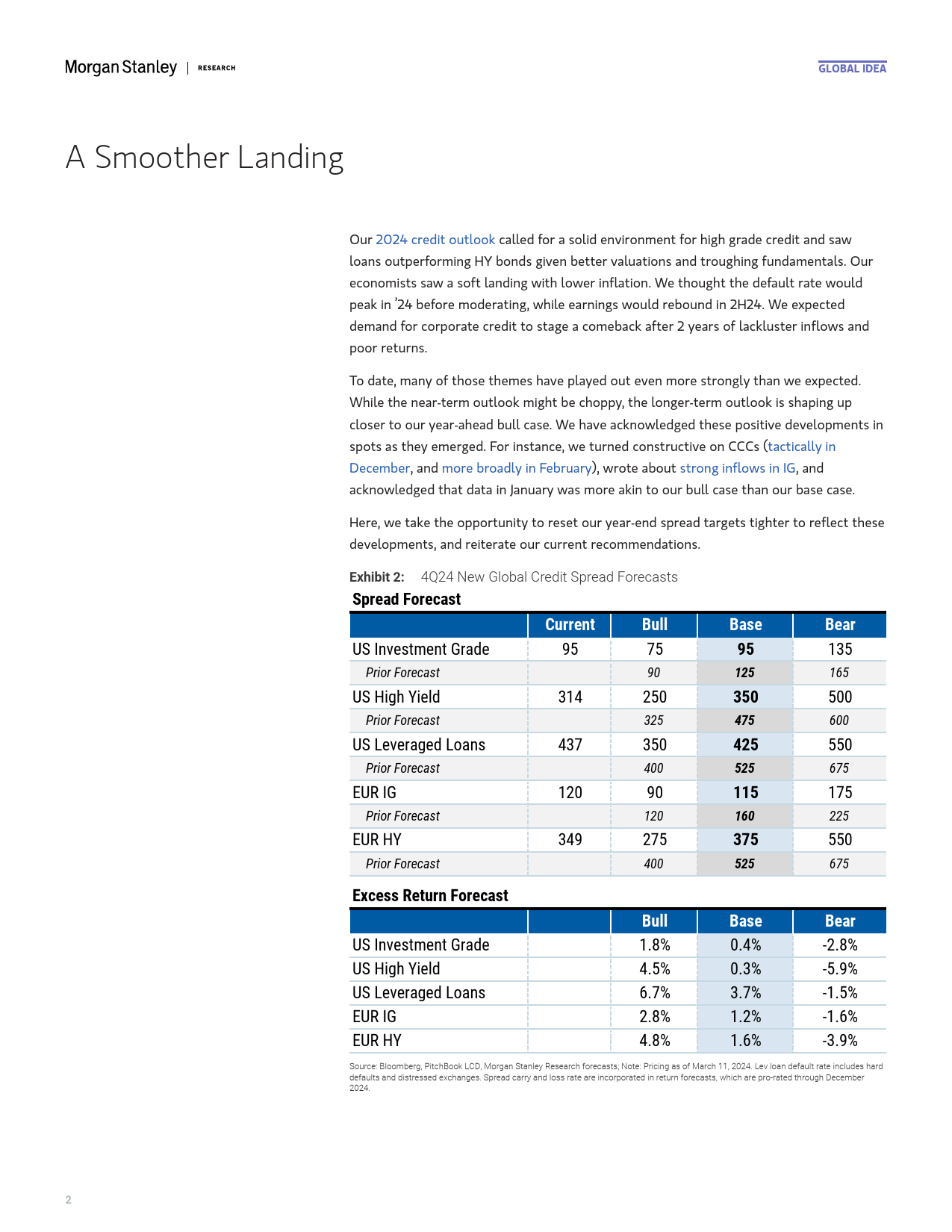

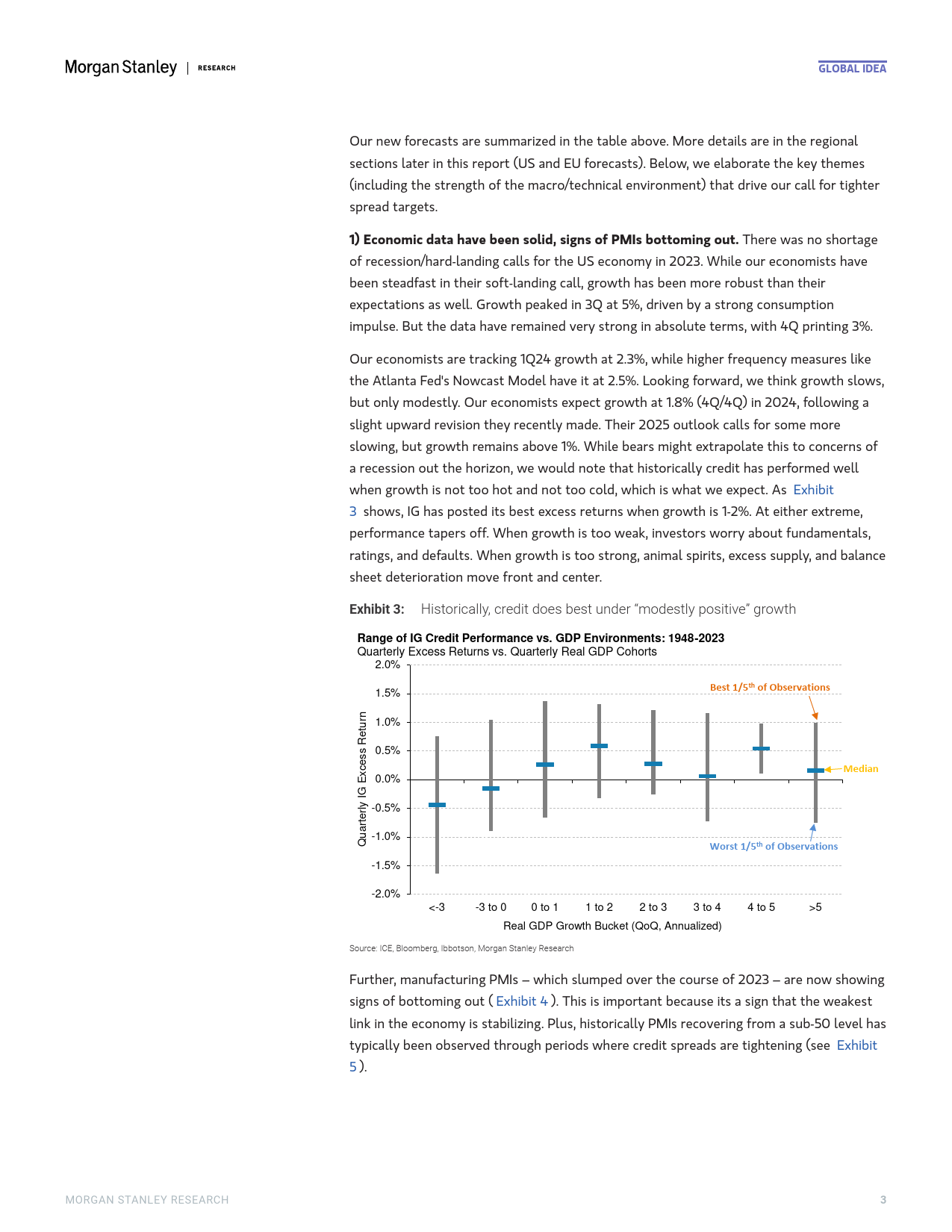

MMarch12,202410:39PMGMTGlobalIdeaGlobalCreditStrategyMorganStanley&Co.LLC+1212761-8041+1212761-0165PreparingforaSmootherVishwasPatkar+1212761-1199Landing+1212761-3117Strategist+1212761-1542WereviseourspreadtargetstighteronthebackofbetterVishwas.Patkar@morganstanley.comgrowth,andstrongertechnicalsthanweexpected.Wenow+44207677-0754preferLoansoverIGandHY.JoyceJiang+44207425-2599KeyTakeawaysStrategistJoyce.Jiang@morganstanley.comSinceour2024outlook,growthandtechnicalshavebeenbetterthanexpected.WereviseourYEspreadforecaststobringthemmoreinlinewiththeseKarenChendevelopments.InUSIG,wereviseourspreadtargetto95bp(from125bp),butexpecttwist-Strategiststeepeninginthecurvetoleadtosub-parexcessreturn(~0.4%).TotalreturnKaren.Chen@morganstanley.comremainsreasonableat~4%.ForUSleveragedcredit,wemoveourHYandLoantargetsto350bpand425bp,IanRobinsondrivenbyCCCcompression.WeexpectbetterexcessreturnsinLoans(3.7%)thanbonds(0.3%).StrategistWemoveourdefaultforecastslowerby0.50-0.75%,to3.75%inHYand4%inIan.Robinson@morganstanley.comLoans.InEURIG,wetightenourspreadtargetto115bp,implyingabove-averagetotalAnlinGZhangandexcessreturnsof6.2%and1.2%,respectively.InEURHY,welowerourspreadtargetto375bp,drivenbycompressionbetweenStrategistBs/CCCs.Inourbasecase,totalreturnsareat6.3%.Anlin.Zhang@morganstanley.comWeplantodiscussthesethemesinmoredetaili...

发表评论取消回复