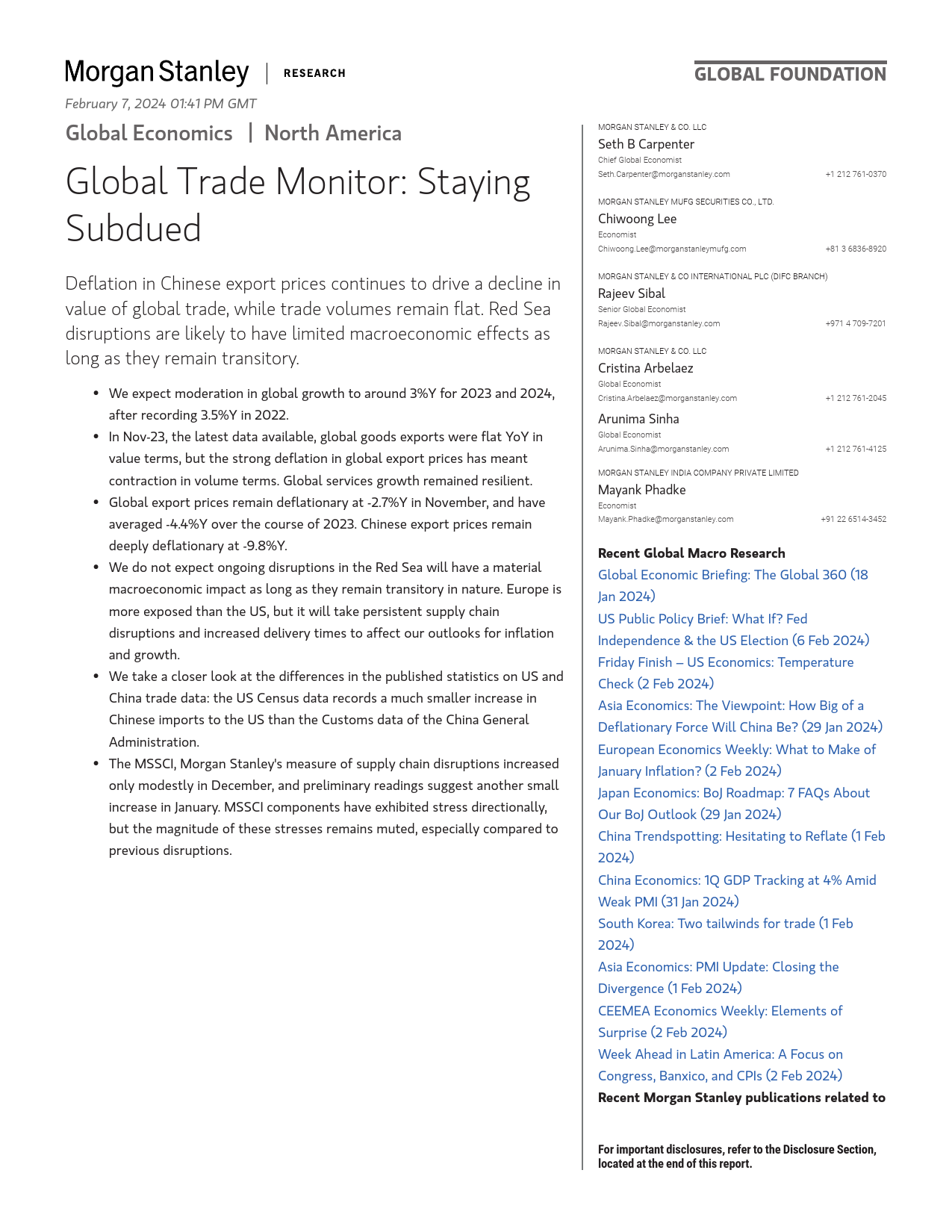

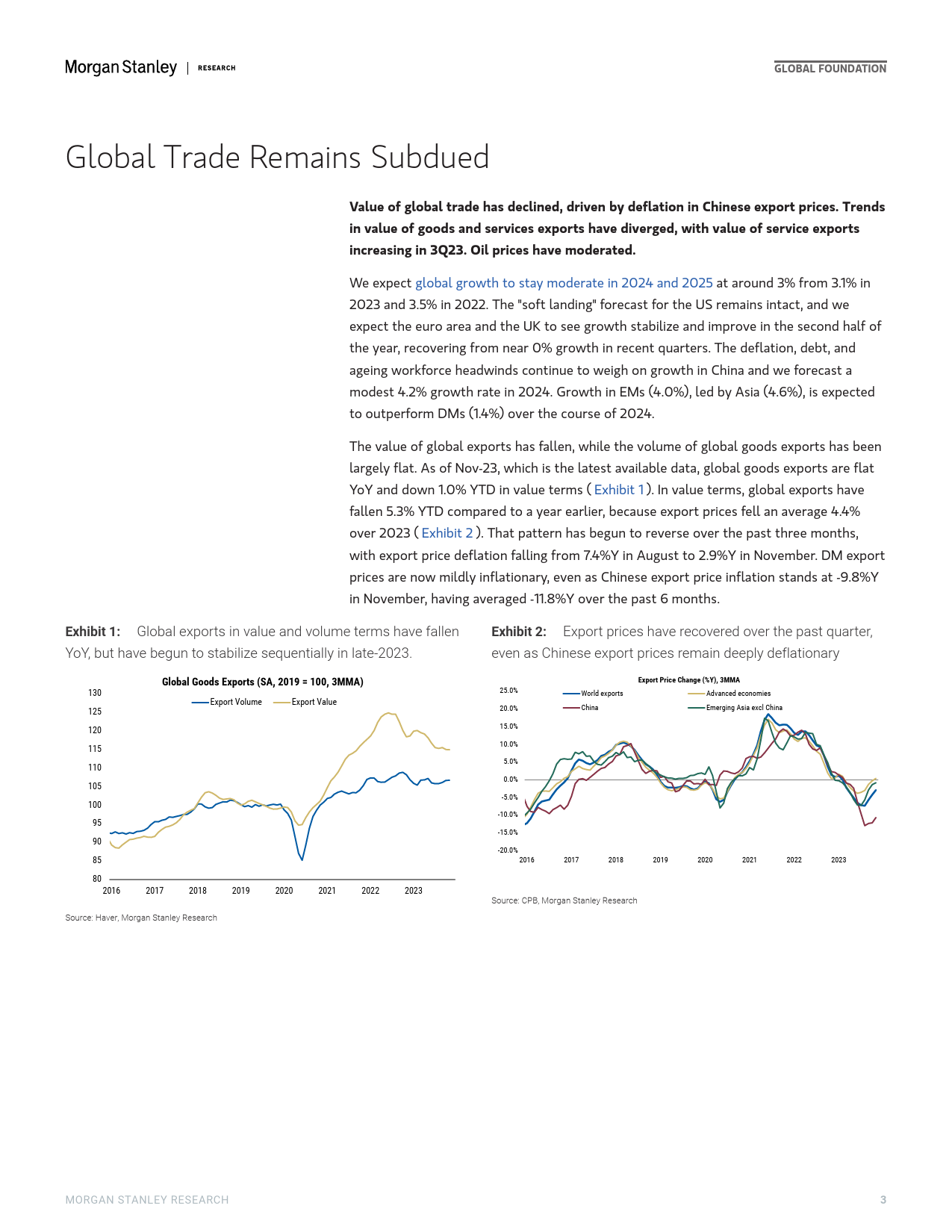

MFebruary7,202401:41PMGMTGlobalFoundationGlobalEconomicsNorthAmericaMorganStanley&Co.LLC+1212761-0370GlobalTradeMonitor:StayingSethBCarpenterSubduedChiefGlobalEconomistDeflationinChineseexportpricescontinuestodriveadeclineinSeth.Carpenter@morganstanley.comvalueofglobaltrade,whiletradevolumesremainflat.RedSeadisruptionsarelikelytohavelimitedmacroeconomiceffectsasMorganStanleyMUFGSecuritiesCo.,Ltd.+8136836-8920longastheyremaintransitory.ChiwoongLee•Weexpectmoderationinglobalgrowthtoaround3%Yfor2023and2024,afterrecording3.5%Yin2022.EconomistChiwoong.Lee@morganstanleymufg.com•InNov-23,thelatestdataavailable,globalgoodsexportswereflatYoYinvalueterms,butthestrongdeflationinglobalexportpriceshasmeantMorganStanley&CoInternationalplc(DIFCBranch)contractioninvolumeterms.Globalservicesgrowthremainedresilient.RajeevSibal•Globalexportpricesremaindeflationaryat-2.7%YinNovember,andhaveaveraged-4.4%Yoverthecourseof2023.ChineseexportpricesremainSeniorGlobalEconomistdeeplydeflationaryat-9.8%Y.Rajeev.Sibal@morganstanley.com+9714709-7201•WedonotexpectongoingdisruptionsintheRedSeawillhaveamaterialmacroeconomicimpactaslongastheyremaintransitoryinnature.EuropeisMorganStanley&Co.LLC+1212761-2045moreexposedthantheUS,butitwilltakepersistentsupplychain+1212761-4125disruptionsandincreaseddeliverytimestoaffectouroutlooksforinflationC...

发表评论取消回复