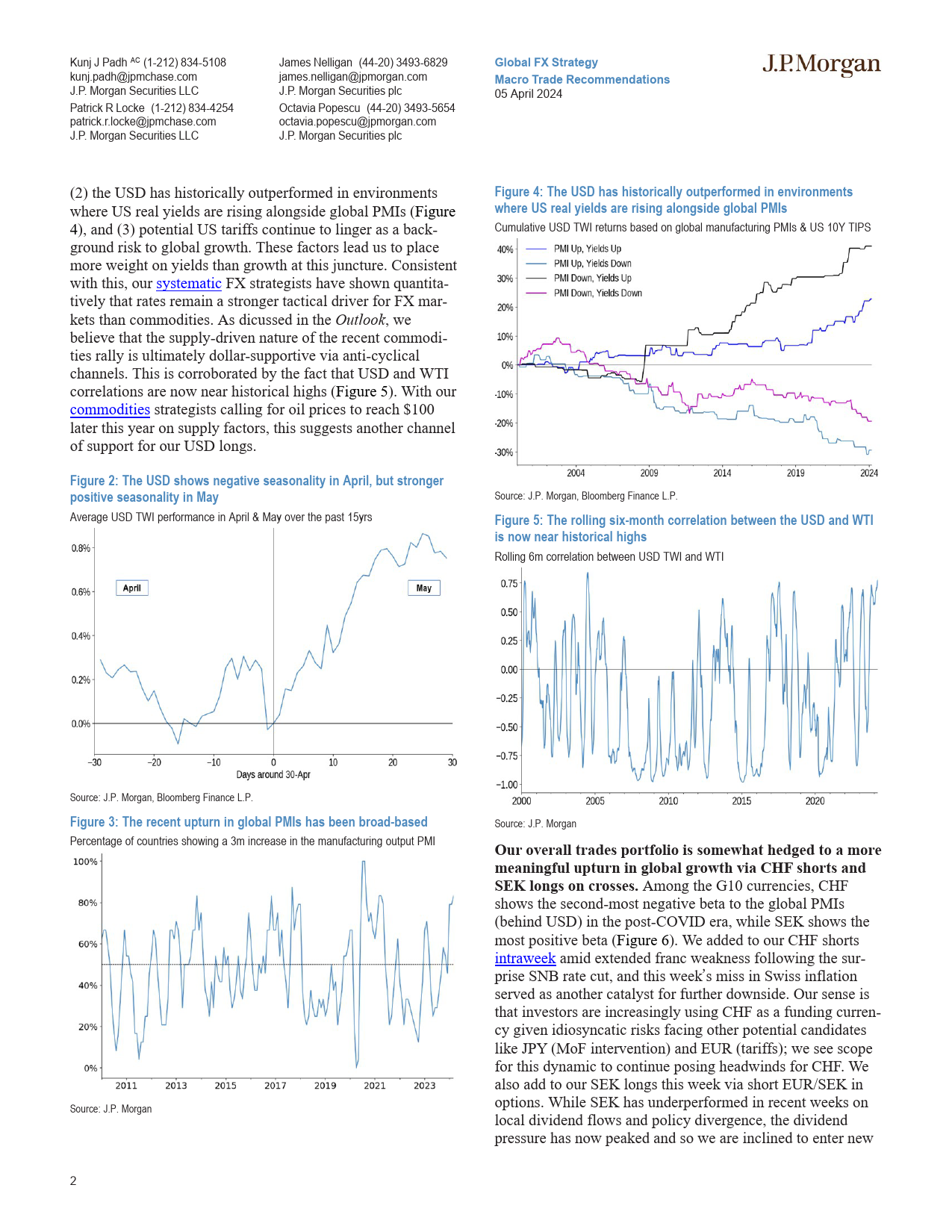

KunjJPadhAC(1-212)834-5108JamesNelligan(44-20)3493-6829GlobalFXStrategyJPMORGANkunj.padh@jpmchase.comjames.nelligan@jpmorgan.com05April2024J.P.MorganSecuritiesLLCJ.P.MorganSecuritiesplcPatrickRLocke(1-212)834-4254OctaviaPopescu(44-20)3493-5654patrick.r.locke@jpmchase.comoctavia.popescu@jpmorgan.comJ.P.MorganSecuritiesLLCJ.P.MorganSecuritiesplcMacroTradeitydatacontinuestopointtoastrongUSeconomy(includingRecommendationsthisweek’sNFPrelease),eveniftherehasbeensomechoppi-nessintheFXpriceaction(e.g.USDralliedonsolidISM•Weincreaseourlong-USDexposureamidcontinuedmfg,butfellonsoftISMservicesthenextday).Nevertheless,theUSyieldcurvehasbearsteepenedoverthepasttwoUSstrengthandrisingprospectsforhigh-for-longweeksandsupportedtheUSDcommensurately.Thishasrates,thoughUSCPIpresentsakeytacticalrisk.coincidedwithpost-FOMCFedspeakturningincrementallymorecautiousaroundthetimingofratecuts,andtheFedOIS•Broadeningglobalgrowthmomentumshouldnotstripnowpricesfewer‘24cutsthantheSEPmediandot—anatypicaldevelopmentforthiscycle(Figure1).WhilethisTheFdOISstripnowcgfuaEPm,ylvderailtheUSDbullcasegivenongoingUSexceptional-mightsuggestriskstotheUSDfrompotentialdovishFedism,elevatedUSyields,andlingeringtariffrisks.repricing,wethinkthemovehigherinthelong-endoftheyieldcurveisindicativeofamoredurabledollarsupport.All•ScaleupCHFshortsvialongUSD/...

发表评论取消回复