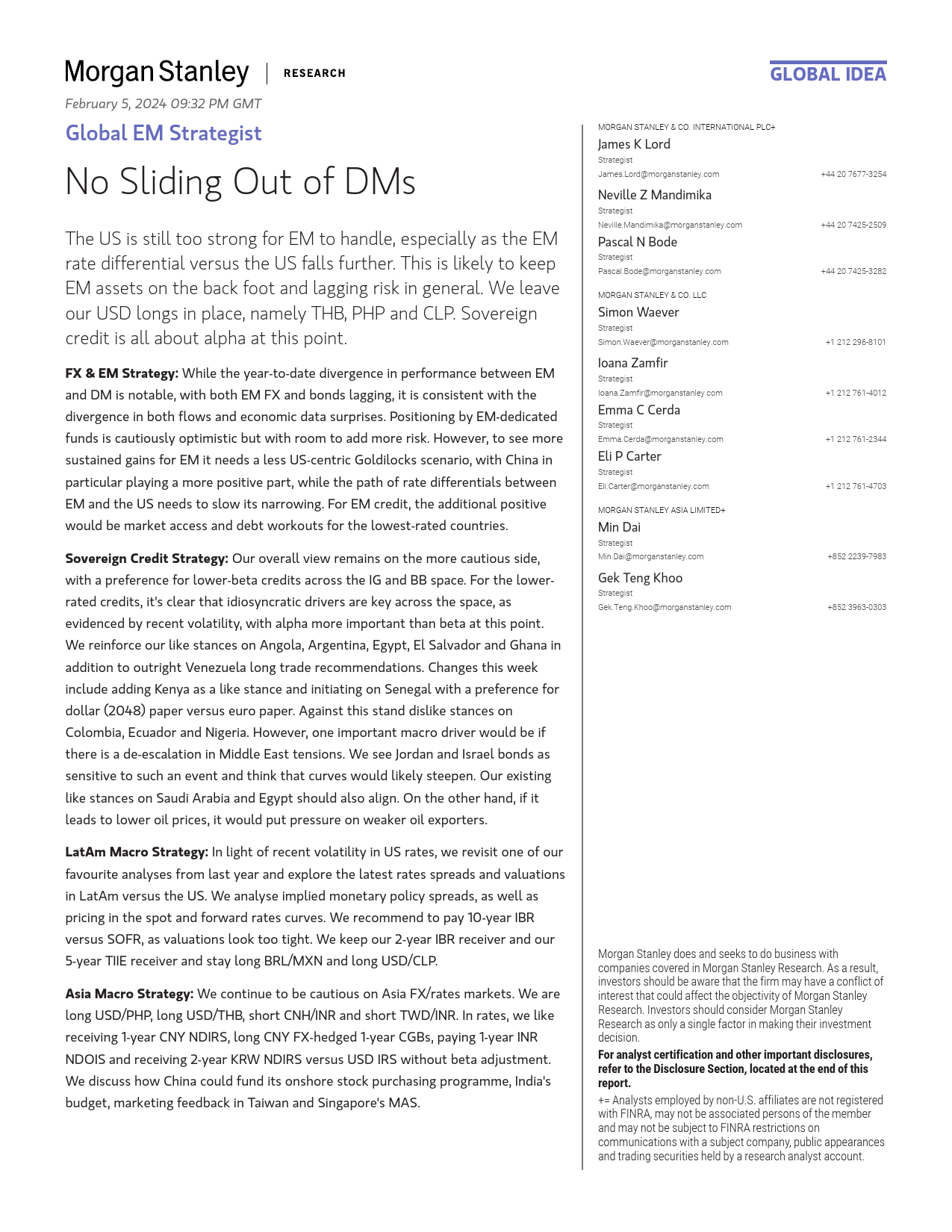

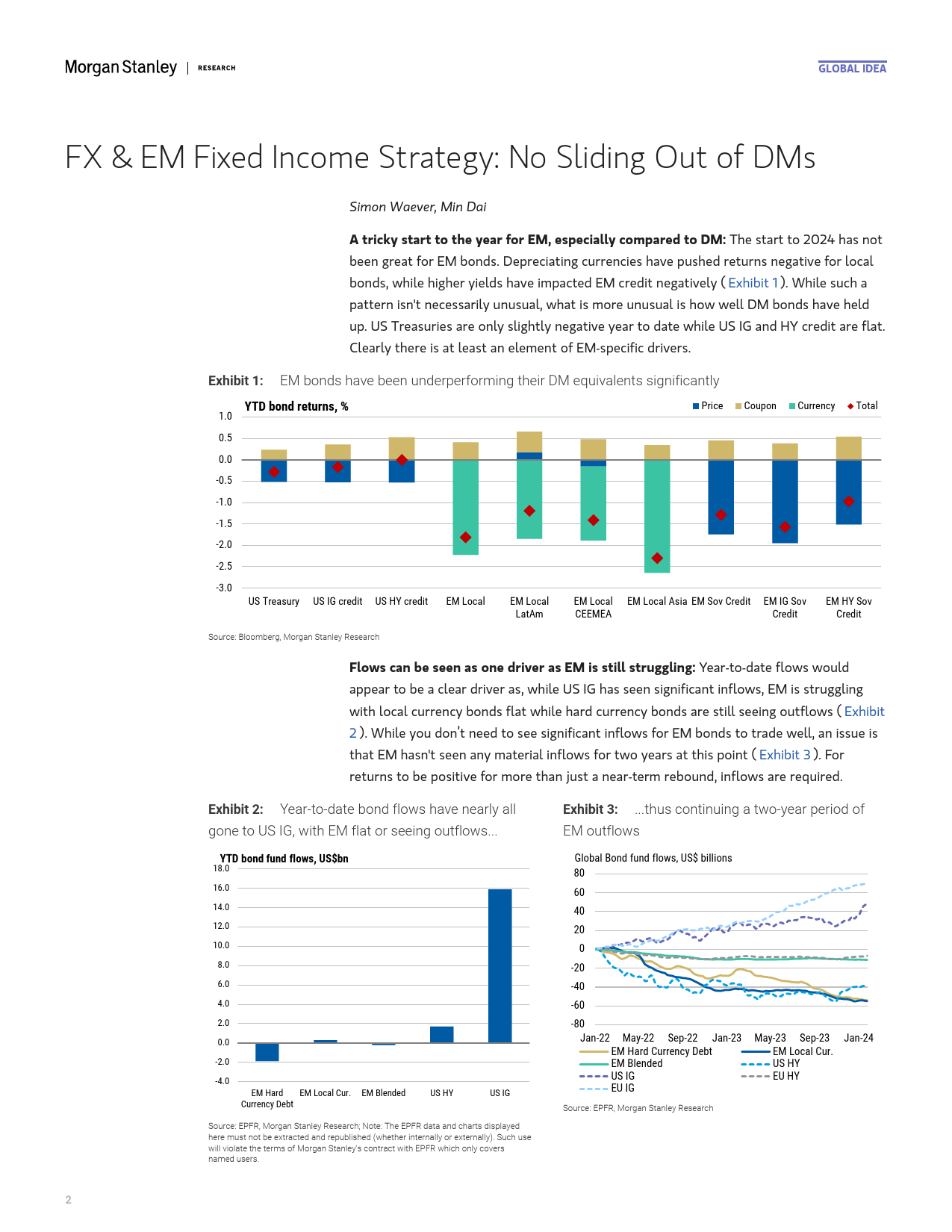

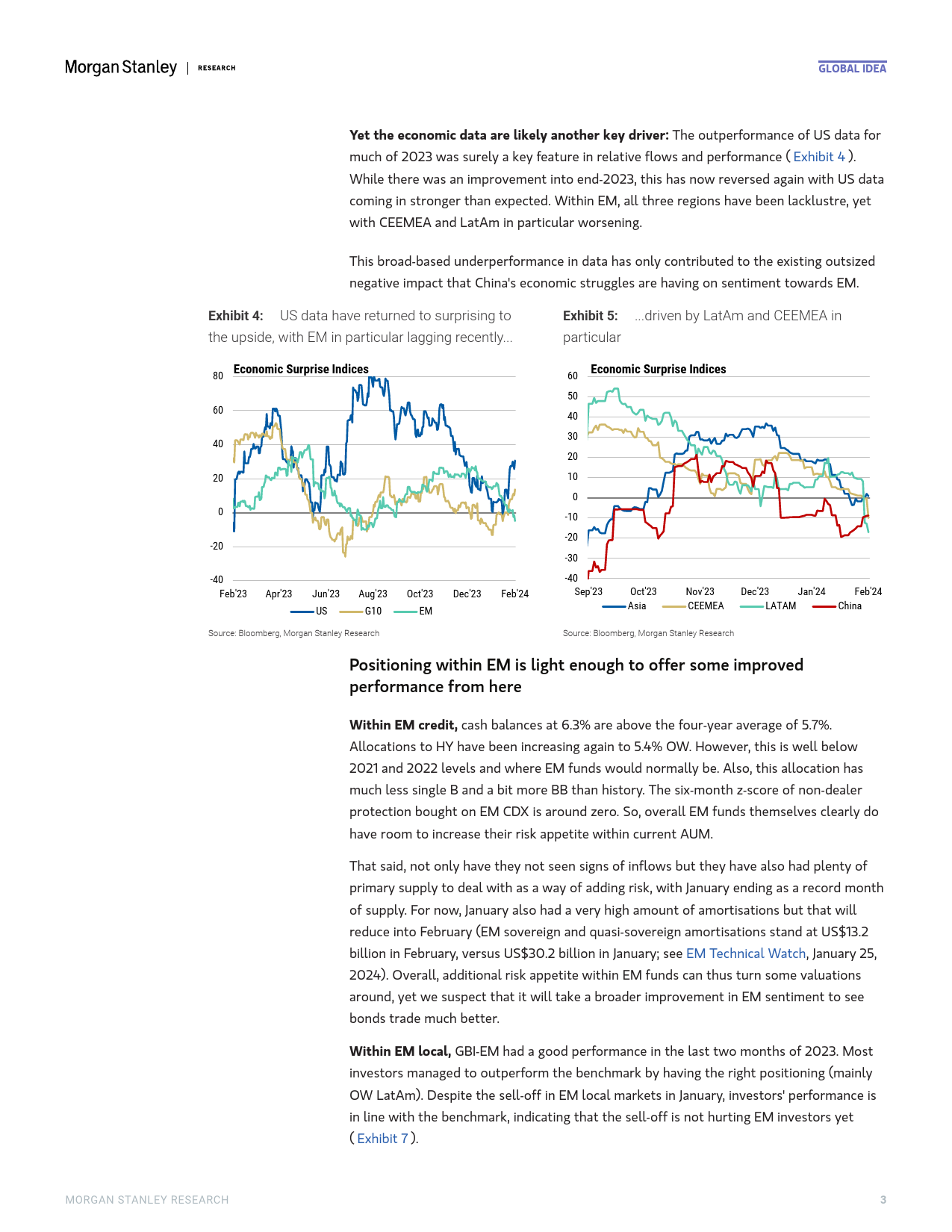

MFebruary5,202409:32PMGMTGlobalIdeaGlobalEMStrategistMorganStanley&Co.Internationalplc++44207677-3254+44207425-2509NoSlidingOutofDMsJamesKLord+44207425-3282TheUSisstilltoostrongforEMtohandle,especiallyastheEMStrategist+1212296-8101ratedifferentialversustheUSfallsfurther.ThisislikelytokeepJames.Lord@morganstanley.com+1212761-4012EMassetsonthebackfootandlaggingriskingeneral.Weleave+1212761-2344ourUSDlongsinplace,namelyTHB,PHPandCLP.SovereignNevilleZMandimika+1212761-4703creditisallaboutalphaatthispoint.Strategist+8522239-7983FX&EMStrategy:Whiletheyear-to-datedivergenceinperformancebetweenEMNeville.Mandimika@morganstanley.com+8523963-0303andDMisnotable,withbothEMFXandbondslagging,itisconsistentwiththedivergenceinbothflowsandeconomicdatasurprises.PositioningbyEM-dedicatedPascalNBodefundsiscautiouslyoptimisticbutwithroomtoaddmorerisk.However,toseemoresustainedgainsforEMitneedsalessUS-centricGoldilocksscenario,withChinainStrategistparticularplayingamorepositivepart,whilethepathofratedifferentialsbetweenPascal.Bode@morganstanley.comEMandtheUSneedstoslowitsnarrowing.ForEMcredit,theadditionalpositivewouldbemarketaccessanddebtworkoutsforthelowest-ratedcountries.MorganStanley&Co.LLCSovereignCreditStrategy:Ouroverallviewremainsonthemorecautiousside,SimonWaeverwithapreferenceforlower-betacreditsacrosstheIGandBBspace.Forth...

发表评论取消回复