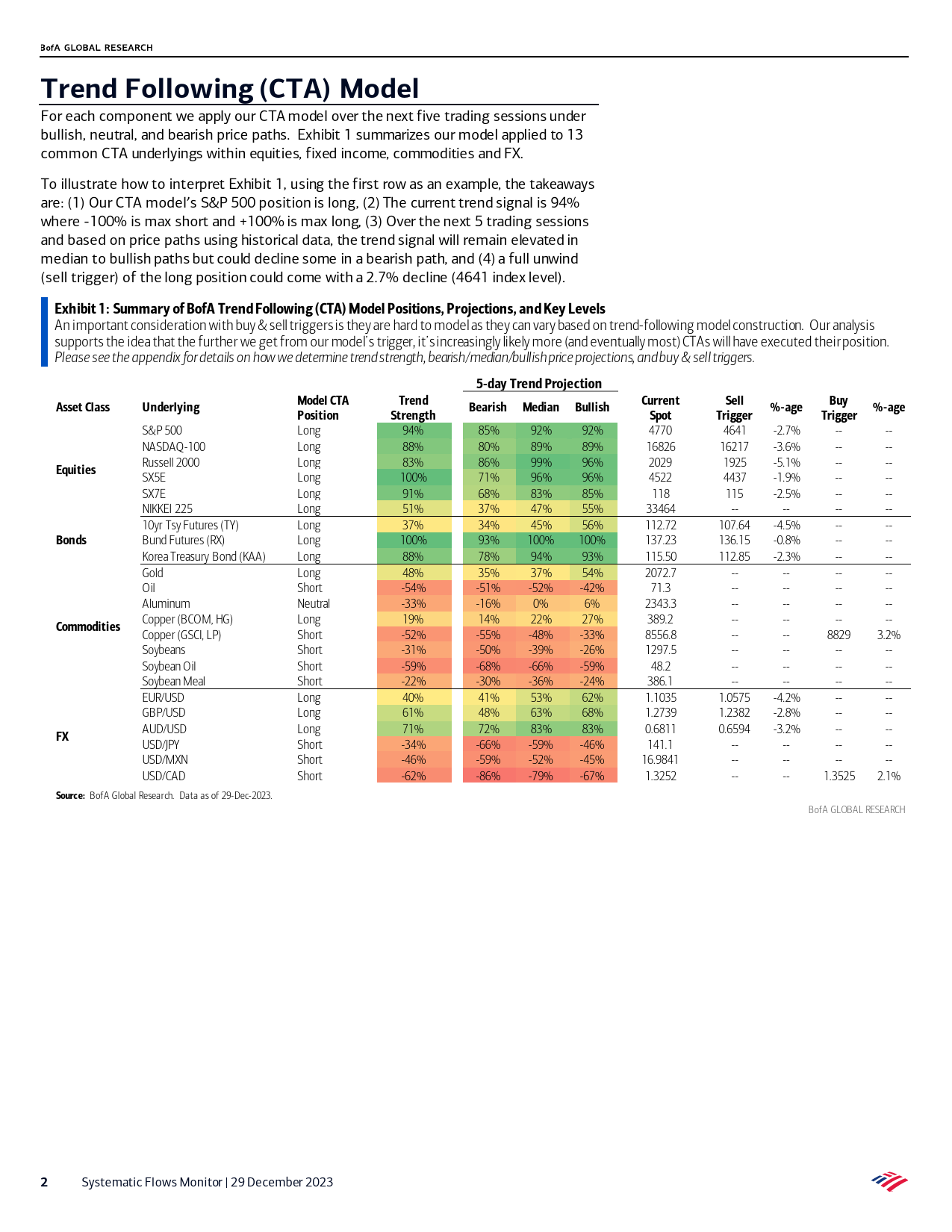

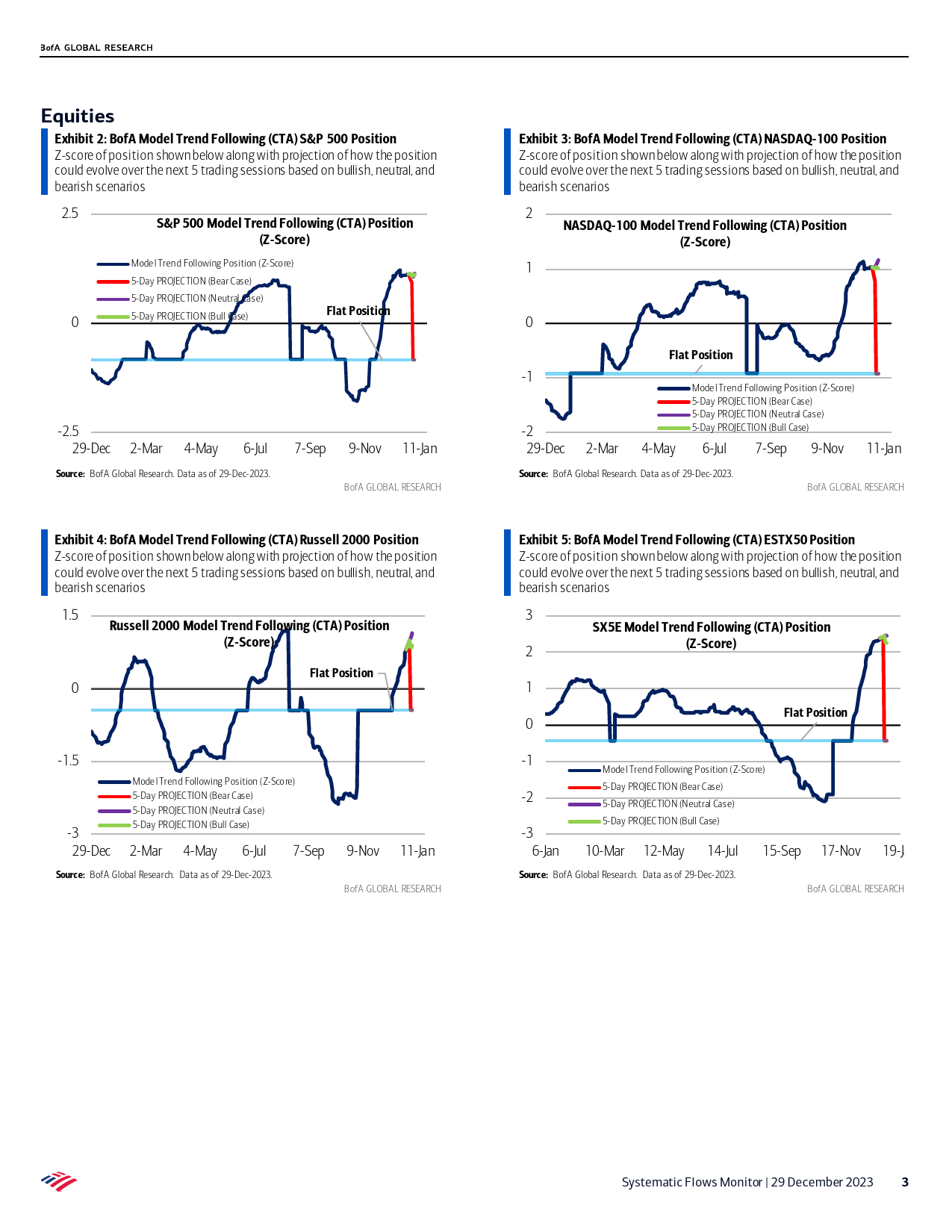

Accessibleversion29December2023SystematicFlowsMonitorEquityDerivativesGlobalCTAsentering2024longequities,longbonds,shortUSD,shortcommoditiesTableofContentsTrendfollowerequitypositioningremainselevatedTrendFollowing(CTA)Model2AccordingtoourCTAmodel,trendfollowershavestretchedequitylongpositionsintheRiskParityModel9S&P500,NASDAQ-100andEUROSTOXX50indexfutures.Aswe’venotedinrecentweeks,theRussell2000longwascatchingupinsizeandinmediantobullishpricepathsS&P500EquityVolControl9overthenextweekthepositionshouldalsobeinstretchedterritory.PositioninginNikkei225futuresisalsolongbutnotatasextremelevels.Ofeachofthesemarkets,Appendix17theEUROSTOXX50longisclosesttoitsstoplosstriggerwhichiscurrently1.9%away(4437indexlevel).Whileourmodelindicatespositioningisstretched,actualCTAscouldResearchAnalysts24stillbeaccumulatingtheirlongsgraduallyinthenear-term.GlobalEquityDerivativesRschCTAsstillhaveroomtoaddtoUSTreasurybondlongsBofASOurCTAmodelindicatesthattrendfollowerscouldstillbeaccumulatinglongsinUSChintanKotechaTreasurybondfutures.TheirpositionshavebeengrowingatasteadypaceinrecentEquity-LinkedAnalystweekswithcontinuedbuyingexpectedinthenear-term.BundlongsarealreadyBofASstretched,however,anda0.8%declineinBundfutures(136.15level)couldtriggerafull+16468555478unwindinourmodel.InourdailyCTAmodelupdate(pleaseemailustobeadded)wechinta...

发表评论取消回复