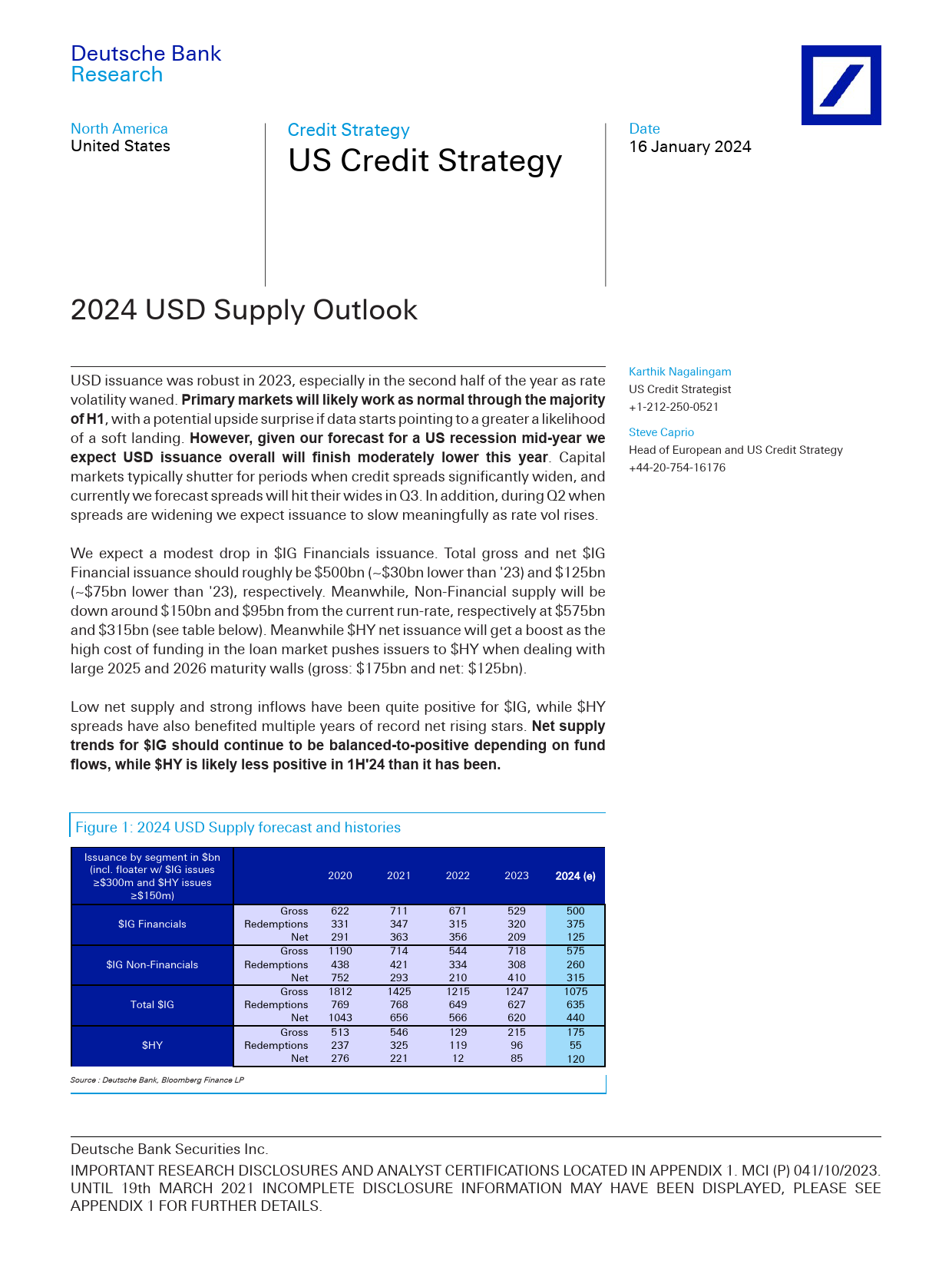

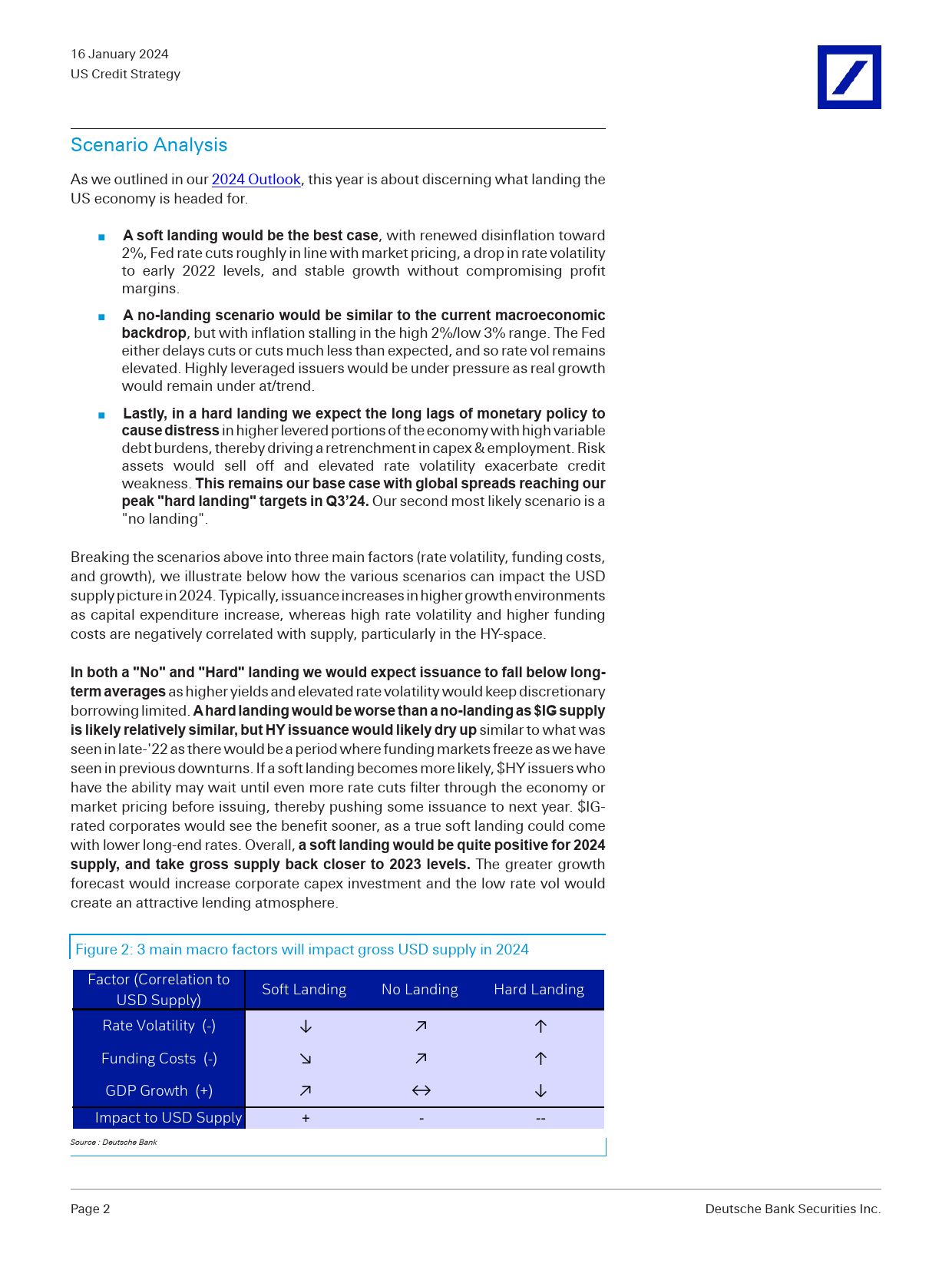

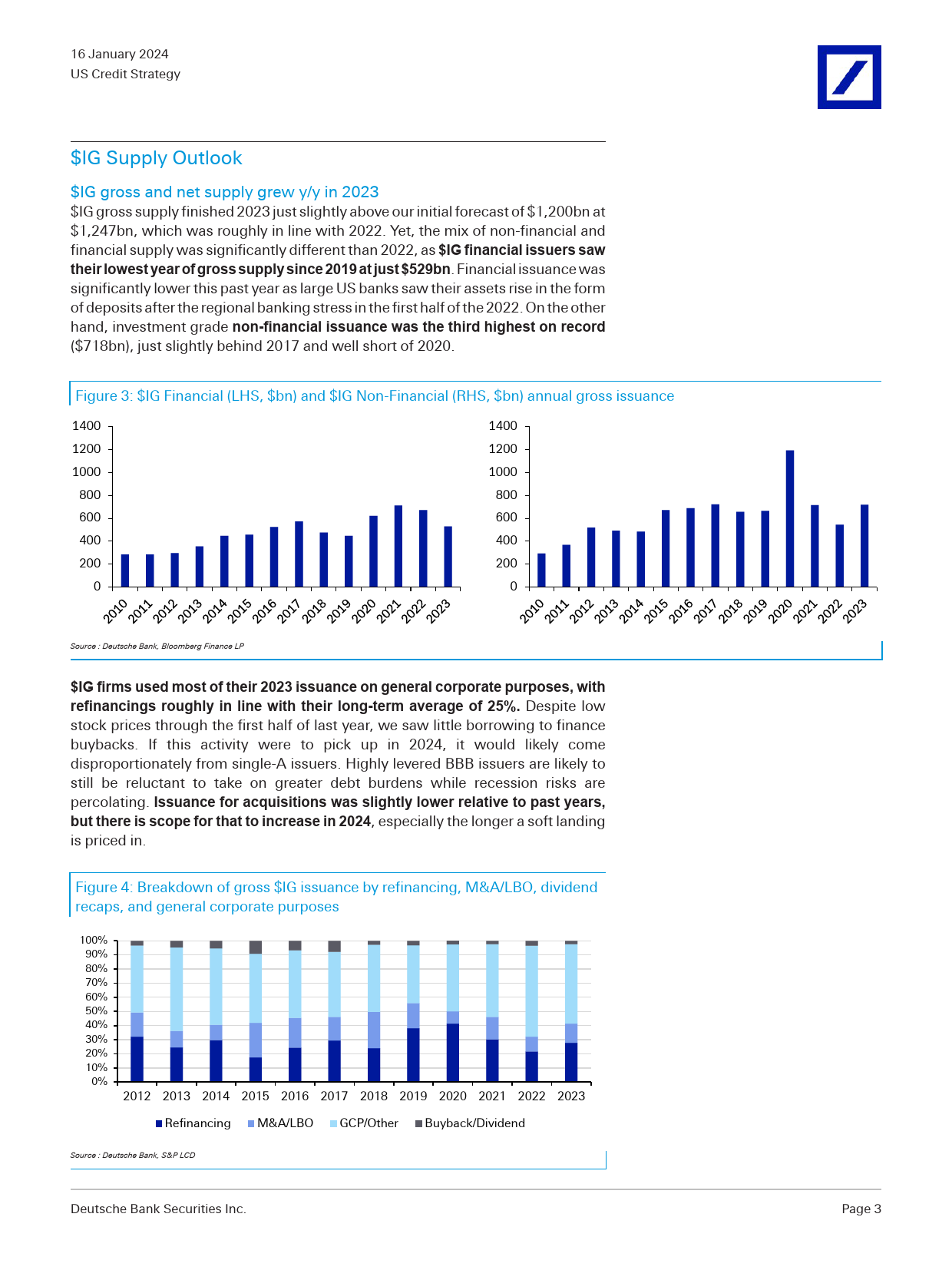

DeutscheBankCreditStrategyDateResearch16January2024USCreditStrategyNorthAmericaUnitedStates2024USDSupplyOutlookUSDissuancewasrobustin2023,especiallyinthesecondhalfoftheyearasrateKarthikNagalingamvolatilitywaned.PrimarymarketswilllikelyworkasnormalthroughthemajorityUSCreditStrategistofH1,withapotentialupsidesurpriseifdatastartspointingtoagreateralikelihood+1-212-250-0521ofasoftlanding.However,givenourforecastforaUSrecessionmid-yearweexpectUSDissuanceoverallwillfinishmoderatelylowerthisyear.CapitalSteveCapriomarketstypicallyshutterforperiodswhencreditspreadssignificantlywiden,andHeadofEuropeanandUSCreditStrategycurrentlyweforecastspreadswillhittheirwidesinQ3.Inaddition,duringQ2when+44-20-754-16176spreadsarewideningweexpectissuancetoslowmeaningfullyasratevolrises.Weexpectamodestdropin$IGFinancialsissuance.Totalgrossandnet$IGFinancialissuanceshouldroughlybe$500bn(~$30bnlowerthan'23)and$125bn(~$75bnlowerthan'23),respectively.Meanwhile,Non-Financialsupplywillbedownaround$150bnand$95bnfromthecurrentrun-rate,respectivelyat$575bnand$315bn(seetablebelow).Meanwhile$HYnetissuancewillgetaboostasthehighcostoffundingintheloanmarketpushesissuersto$HYwhendealingwithlarge2025and2026maturitywalls(gross:$175bnandnet:$125bn).Lownetsupplyandstronginflowshavebeenquitepositivefor$IG,while$HYspreadshavealsobenefitedmultipleyearsofrec...

发表评论取消回复