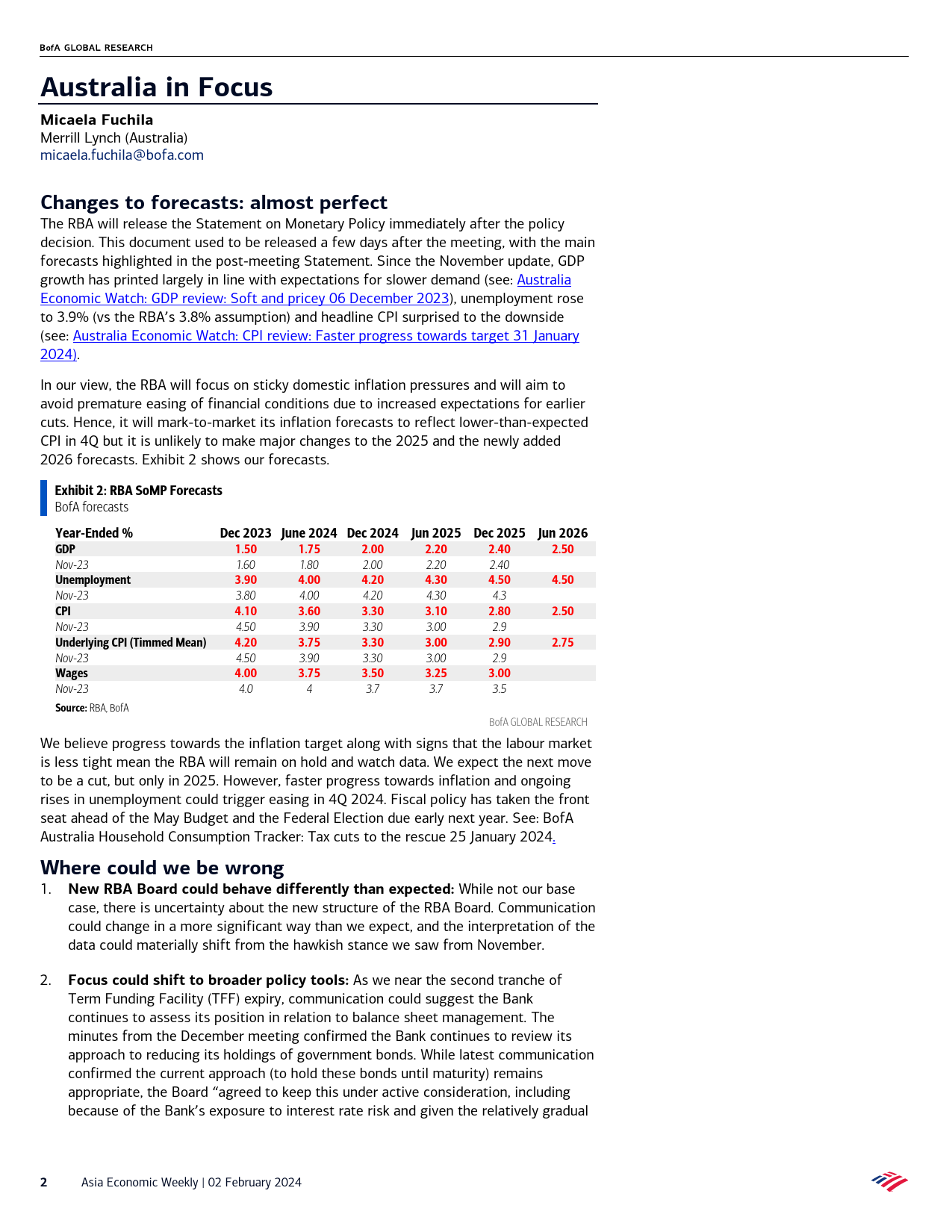

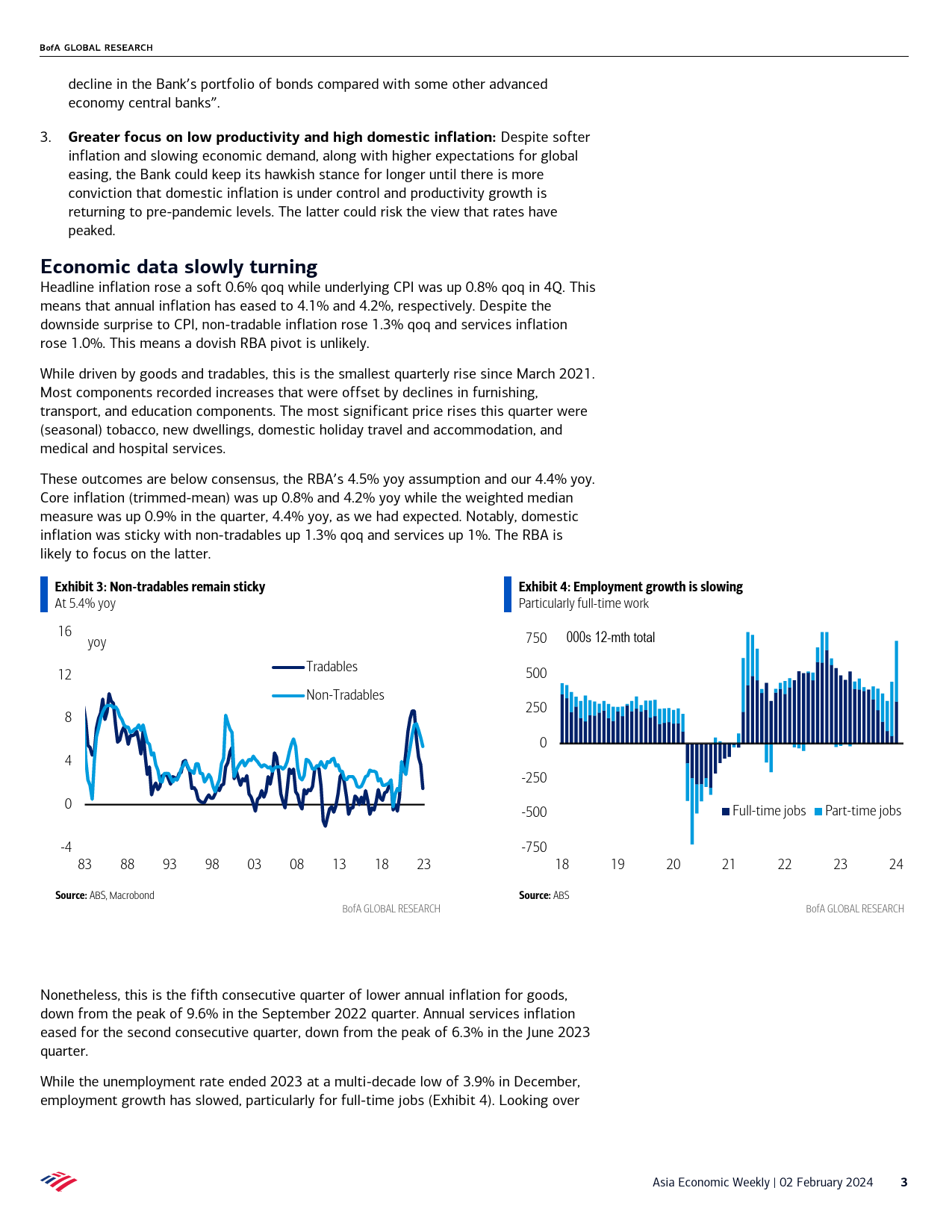

AccessibleversionAsiaEconomicWeeklyAustralia–RBAsettohold,dovishpivotseemsunlikelySofterCPIincreasesexpectationsforearliercuts02February2024ThenewRBAboardmeetson5-6Feb,andweexpectratestobeonholdat4.35%.GEMFixedIncomeStrategy&Inflationended2023at4.1%.ThisislowerthantheRBA’sassumptionof4.5%andtheEconomicslabormarketremainsingoodshape.Whileadovishpivotisunlikelyatthismeeting,weAsiaexpectchangesintonetoaddressfurthertractionfromhighrates,progresstowardstheCPItargetandconfirmationthatrateshavepeaked.TableofContentsAStatementonMonetaryPolicy,newforecastsandapost-meetingspeechwillbeAustraliainFocus2deliveredrightafterthedecisionforthefirsttime.ChangestotheRBABoardandlengthofthemeetingsshouldbereflectedintheusualpost-meetingstatement.DataPreview5MacroForecasts6ResearchAnalysts10DespitethedownsidesurprisetoCPI,non-tradableinflationrose1.3%qoqandservicesHelenQiaoinflationrose1.0%.Indeed,inflationexpectationshavemovedsideways.ThismeansaChina&AsiaEconomistdovishpivotisunlikely,inourview.Nonetheless,mark-to-marketchangestotheRBAMerrillLynch(HongKong)forecastssuggestthemid-pointoftheinflationtargetcouldbereachedearlierthanhelen.qiao@bofa.comanticipated.WecurrentlyexpectthefirstcutinFebruary2025butfasterprogresstowardstheCPItargetsincreasestheprobabilityofearliercuts.IzumiDevalierJapanandAsiaEconomistExhibit1:Inflationexp...

发表评论取消回复